Classic cars of all ages can be a good investment. According to a National Automobile Dealers Association (NADA) price survey the value of classic cars worth more than $125,000 dollars increased almost 50% over the past four years, while cars in the $75,000 to $100,000 range appreciated 45% and those between $25,000 and $50,000 rose 39%. Over half of the classic cars that gained were priced under $10,000. In fact, the classic car market has become such a viable investment that there are now two funds that specialize in them.

In England, the Federation of British Historic Vehicle Clubs recently reported to Houses of Parliament that the classic car market is alive and strong and related auto employment is at an all time high in Great Britain. They claim that both sales and employment of classic car related businesses are up. They also pointed out that about a third of classic car owners earn less than $25,000 pounds ($37,000 US dollars) per year; almost 70% of the nation-wide classic cars are worth less than $10,000 pounds ($15,000 US dollars); only three percent are worth more than $50,000 pounds ($75,000 dollars); over one-third of the 850,000 classic cars in England have been resold over the last five years; most of the 28,000 people who make money from classic cars are under 45 years old; and most classic cars are driven less than 500 miles per year. In February, 2012, Emma Simon reported in The Telegraph (a British newspaper), that classic car prices outperformed equities and gold the previous year with some segments increasing by 20 percent. Ms. Simson is quoted as stating the price of precious commodities generally go up when the economy goes down and that has held true for rare stamps, fine wines, art, gold and antique and classic cars. However, she also warned that such items can be less stable than long-term savings and should therefore be invested in more cautiously. Classic cars in particular, she said, are "subject to depreciation due to wear and damage".

Hardy Singh Sohanpal, co-founder of the Historic Auto Group, says that "Investing in cars has been very successful".

Robert Coucher, editor of Octane Magazine, says "Classic cars are a great way to put your money into something safe and collectible".

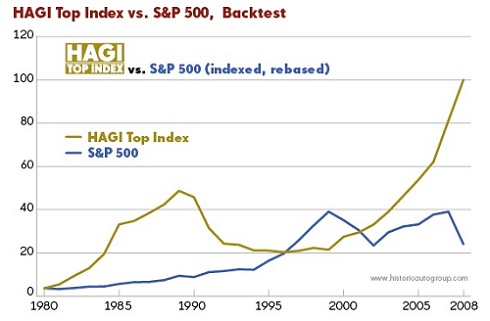

In 2008 Dietrich Hatlapa, founder of the HAGI (Historic Automobile Group International) Indices, said: "We've discovered that classic cars move independently of any other investment area. That's an attractive attribute for collectors and investors alike". According to Mr. Hatlapa classic cars have been appreciating at the rate of about 12 percent per year, as compared to gold at just over two percent per year. However, he cautions that successful investments vary widely from car to car and most of the profits can be attributed to high-end vehicles. He suggests that you invest as much as you can afford based on the vehicle's history, condition, originality, and provenance. The HAGI chart* to the right tells the whole story!

HAGI Top Index vs. S&P 500 *

|

Search For Your Favorite Vehicle

Enter keywords (Ex: 1919 Ford, black) or filter

|

Shopping, collecting, restoring, showing and cruising the local boulevards are all benefits to entering the "classic car" marketplace but do not be misled by the name. The Classic Car Club of America (CCCA) defines a classic car as being build between 1925 and 1948. The Antique Automobile Club of America (AACA) defines them as being 25 to 45 years old. There are some collectors that believe a vehicle only need be out of production to qualify as a classic car. There are also wide variations among country and state licensing agencies as well. Personally, I think of classic cars as being built after World War II, and in particular those beefy muscle cars that we "souped up" - until the 1972 Clean Air Act complicated things by forcing manufacturers to detune engines to meet the new emission standards. The message here is that the term "classic car" has little meaning regarding value. The only thing that matters is how badly somebody else wants it. The most valuable classic cars are therefore the rarest of the "best" with attributes such as the highest original price, the best engineered, the most admired, the best documented and the least number remaining. The 1936 Bugatti 57SC Atlantic, of which only three remain, is thought of as the most valuable car in the world and one sold for about $30 million dollars in 2010!

The facts are in about England and the U.S. and when you add the emerging markets in Russia and China it is evident that the classic car marketplace is bound to stay strong. A good way to get started is to look for clubs and organizations in your area and get involved. Most do not require that you own a vehicle for membership and many are involved with restoration projects, a great venue for learning. If you are ready to buy, do your homework first. Study the make and model thoroughly before you start shopping and know the current market value before you make an offer. If you are looking for a collectible asset documentation is important. Ideally you want a picture and paper history of everything done and proof of previous ownership. Keep in mind that the most valuable vehicles are totally original, meaning all the parts with serial numbers, such as the engine, transmission and frame match the documentation and all the colors and fabrics match factory specifications, and preferably original. If owning a classic car without doing all the work is your dream, have no fear! There are thousands of professional assessors, dealers and representatives who will do the looking and biding for you. And there are a number of well know collections with vehicles for sale that have all the proper documents at the ready.